Rebate of State and Central Taxes and Levies

The Rebate of State and Central Taxes and Levies (RoSCTL) Scheme is a significant initiative introduced by the Indian government to promote the export of garments and made-ups. Under the RoSCTL scheme, exporters receive refunds or rebates on various state and central taxes and levies that are not refunded under existing schemes such as the Goods and Services Tax (GST) regime. These include taxes such as embedded central and state levies on inputs, including fuel, electricity, and transportation, which are not exempted or refunded under other export promotion schemes.

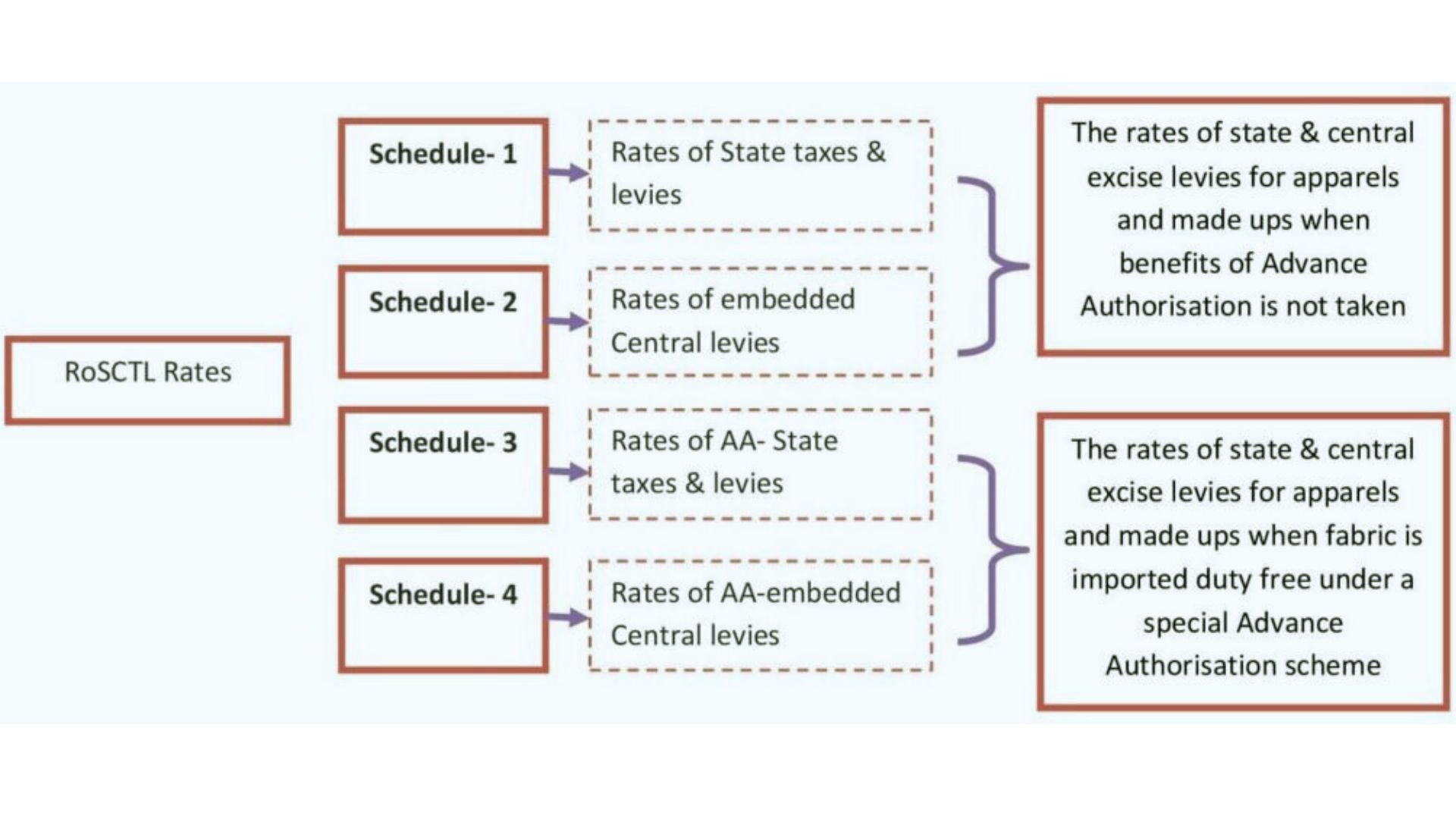

RoSCTL scheme

The RoSCTL scheme aims to address the issue of embedded taxes and levies that make Indian exports less competitive in international markets. By providing refunds on these taxes and levies, the scheme reduces the cost of production for exporters, thereby enhancing their competitiveness and profitability. Moreover, the scheme helps mitigate the impact of cascading taxes and levies on exports, which can act as a barrier to the growth of India’s garment and made-up exports.

Furthermore, the RoSCTL scheme aligns with the government’s broader objective of promoting the growth of the textile and apparel sector and increasing its contribution to India’s economy and employment. By incentivizing exports through the RoSCTL scheme, the government aims to boost the competitiveness of Indian textile and apparel manufacturers, attract investment, and create jobs in the sector. Additionally, the scheme supports the government’s vision of making India a global manufacturing hub for textiles and apparel by facilitating the expansion of exports and enhancing the sector’s integration into global value chains. Through its targeted incentives and strategic focus, the RoSCTL scheme plays a crucial role in driving the growth and competitiveness of India’s textile and apparel sector on the global stage.